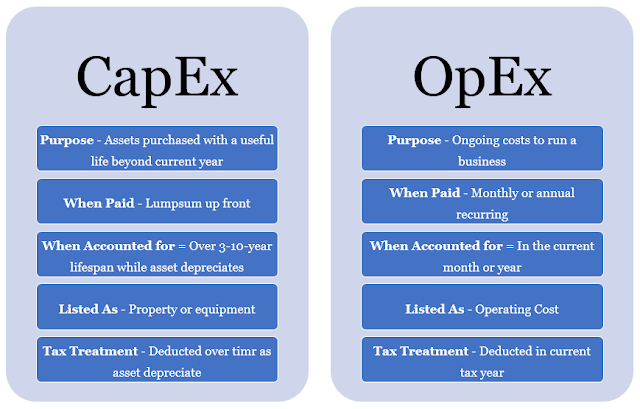

Operational Expenditure (OpEx) is spending money on services or products now and being billed for them now. You can deduct this expense from your tax bill in the same year. There's no upfront cost. You pay for a service or product as you use it.

With Cloud Computing, many of the costs associated with an on-premises data centre are shifted to the service provider. Instead of thinking about physical hardware and data centre costs, cloud computing has a different set of costs. For accounting purposes, all these costs are operational expenses:

Leasing software and customized features

Using a pay-per-use model requires actively managing your subscriptions to ensure users do not misuse the services, and that provisioned accounts are being utilized and not wasted. As soon as the provider provisions resources, billing starts. It is your responsibility to de-provision the resources when they aren't in use so that you can minimize costs.

Scaling charges based on usage/demand instead of fixed hardware or capacity

Cloud computing can bill in various ways, such as the number of users or CPU usage time. However, billing categories can also include allocated RAM, I/O operations per second (IOPS), and storage space. Plan for backup traffic and data recovery traffic to determine the bandwidth needed.

Billing at the user or organisation level

The subscription (pay-per-use) model is a computing billing method that is designed for both organisations and users. The organisation or user is billed for the services used, typically on a recurring basis. You can scale, customize, and provision computing resources, including software, storage, and development platforms. For example, when using a dedicated cloud service, you could pay based on server hardware and usage.